Frequently Asked Questions

Start here

Why your app balance isn’t the same as your bank balance

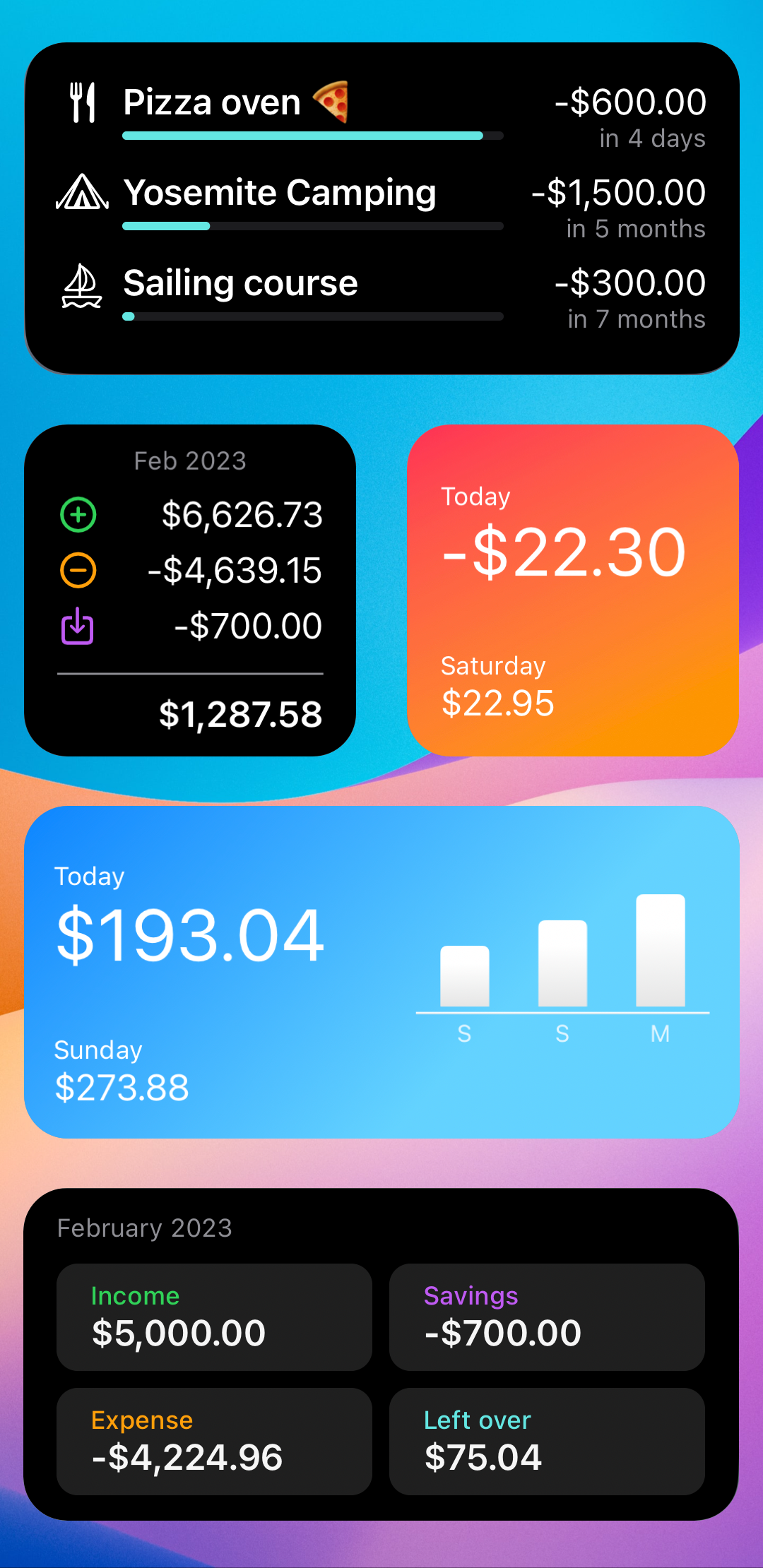

TL;DR Your bank balance and your Today’s Budget balance will never match, and that’s on purpose. The app uses accrual accounting (spreading out big bills and paychecks over time) so you see a steadier, more realistic picture of what’s safe to spend each day.

In Today’s Budget, your balance won’t always match your bank account, and that’s intentional.

Most budget apps simply copy your bank balance. We do something different.

Everyday expenses are subtracted right away, just like your bank would.

Larger bills such as rent or insurance are spread out over the period they cover.

Income is also spread out across the time it needs to last, so your paycheck supports you day by day instead of feeling like a lump sum that disappears too fast.

This approach comes from accrual accounting, the method big companies use to measure financial health. Instead of taking a big cost all at once, the expense is amortized (spread out), across the time it applies to. Accountants call this the matching principle: making sure expenses and income are counted in the period they belong to. This gives a clearer, more balanced view than looking at cashflow alone.

Today’s Budget brings this same idea to everyday money management. You don’t have to know accounting, because the app does the math for you. What you see is a steady, realistic picture of what’s safe to spend today, even if you have big bills coming up.

Example

Bank: You have €1000. You pay €500 rent, and the balance drops to €500. On payday, you get €3000, so your balance suddenly jumps to €3500.

Today’s Budget: When you receive your €3000 paycheck, the app spreads it evenly over the month (about €100/day), so it lasts until your next payday. €500 rent is spread across 30 days (about €17/day), so after rent you’ll see about €83 left.

Instead of sudden drops and spikes, the app smooths things out, giving you the same complete view that companies use to stay financially healthy.

Set up your first budget

1. Create a wallet

Go to Settings > Manage your wallets, tap +, then edit it to set your currency. When you’re ready, select Show this wallet.

2. Add your income

Tap + on the Today page, choose Income, and enter your post-tax income with the right pay frequency. Budgeting with a partner? Add their income too. Freelance or variable income? Use One-off income and spread it across the days you want.

3. Add regular bills

Tap + > Recurring expense and add things like rent or insurance. Choose how often they repeat (monthly, yearly, etc.). The app saves a little each day so you’re always ready when the bill arrives.

4. Put aside money for the future

Tap + > Saving jar > Regular saving to set aside a fixed amount every month. This is your general savings, like a safety net or savings for future.

5. Track your daily spending

Every time you spend, tap + > Expense. These get deducted from Today’s Budget. Keep your expenses within this limit so you can pay your bills and grow your saving.

6. Create a savings goal

Want to save up for a holiday, a new gadget, or something else specific? Tap + > Savings goal, enter the amount and target date, and the app will guide you to set money aside each day until you reach it.

7. Leftover money rolls over to the next day!

Any money you don’t spend rolls over to the next day. This means if you save today, you can splurge tomorrow!

Alternatively, you can tap + > Save balance to move it into savings right away.

Getting started when cash is tight

We usually say “start today”. But if you’ve got big bills due soon and you’re worried about cashflow, here’s a step-by-step approach to get started safely:

1. Enter your current balance

Add your bank balance as a one-off income, mark it as cash on hand, and spread it until your next paycheck (say the 27th). This gives you a daily budget until then.

2. Add upcoming bills

Log the bills as Repeating Expenses you know are coming before payday. Spread them out until the same date as your initial funds (27th). This makes sure money is set aside for those payments.

3. Add your salary

Set your salary as a recurring income starting on payday. From then on, your daily budget will be based on your actual income.

4. Add recurring bills

Enter all regular expenses (rent, insurance, subscriptions). The app will subtract a little each day so you’re ready when each bill arrives.

5. Put aside savings

Turn on the saving jar, tap Add saving > Regular saving, and set aside a small daily amount for long-term savings. Even when cash is tight, a little adds up.

👉 The app now shows Today’s Budget, the amount you can safely spend today. Check in daily, log expenses as they happen, and you’ll always know what’s safe to spend, even with big bills ahead.

Do I need to add past expenses?

Nope, you don’t need to enter expenses from before you started using the app. Your budgeting begins fresh from the day you create your wallet.

We designed it this way because:It’s nearly impossible to remember every past expense.If you only enter some of them, the numbers might look higher than they really are.

Starting fresh keeps everything clean and accurate, and you can move forward without worrying about the past.

Start fresh after a break

1. Go to Settings > Manage wallets

2. Tap + and create a new wallet

This gives you a completely clean start with no past data.

If you want to keep your recurring expenses, income, and categories

Go to Settings > Manage wallets > Edit to open the wallet you are using > Edit the start date of your current wallet to today.

Your setup stays the same, but your budget resets from this point forward.

Reset your budget to zero

Want to start fresh with your daily balance? You can reset it with just one tap:

If your balance is positive, tap Save balance in the menu. The leftover money is moved into your savings jar, and your daily balance goes back to zero.

If your balance is negative, tap Offset balance. The app will take the missing amount from your savings jar so your balance returns to zero.

You can schedule regular resets with the Shortcuts app on iPhone.

1. Open Shortcuts → tap the Automation tab.

2. Tap New Automation (or +), then Create Personal Automation.

3. Pick when it should run (daily, weekly, monthly, or a specific date/time).

4. Tap Add Action → search Today’s Budget → choose Reset Budget.

5. Tap Next, then turn Ask Before Running off (so it runs automatically).

6. Tap Done.

Tips: Choose any schedule you like (e.g., every Friday at 18:00, or on the 1st of each month).

You can pause or edit the automation anytime in Shortcuts → Automation.

Change your currency

Go to Settings > 'Manage wallets ' > tap on 'Edit' to open the wallet you are viewing then tap on Currency. Then tap 'Save'.

Tracking money

Add your income (regular paycheck, self-employed, one-off income)

There are two ways to set up income in Today’s Budget:

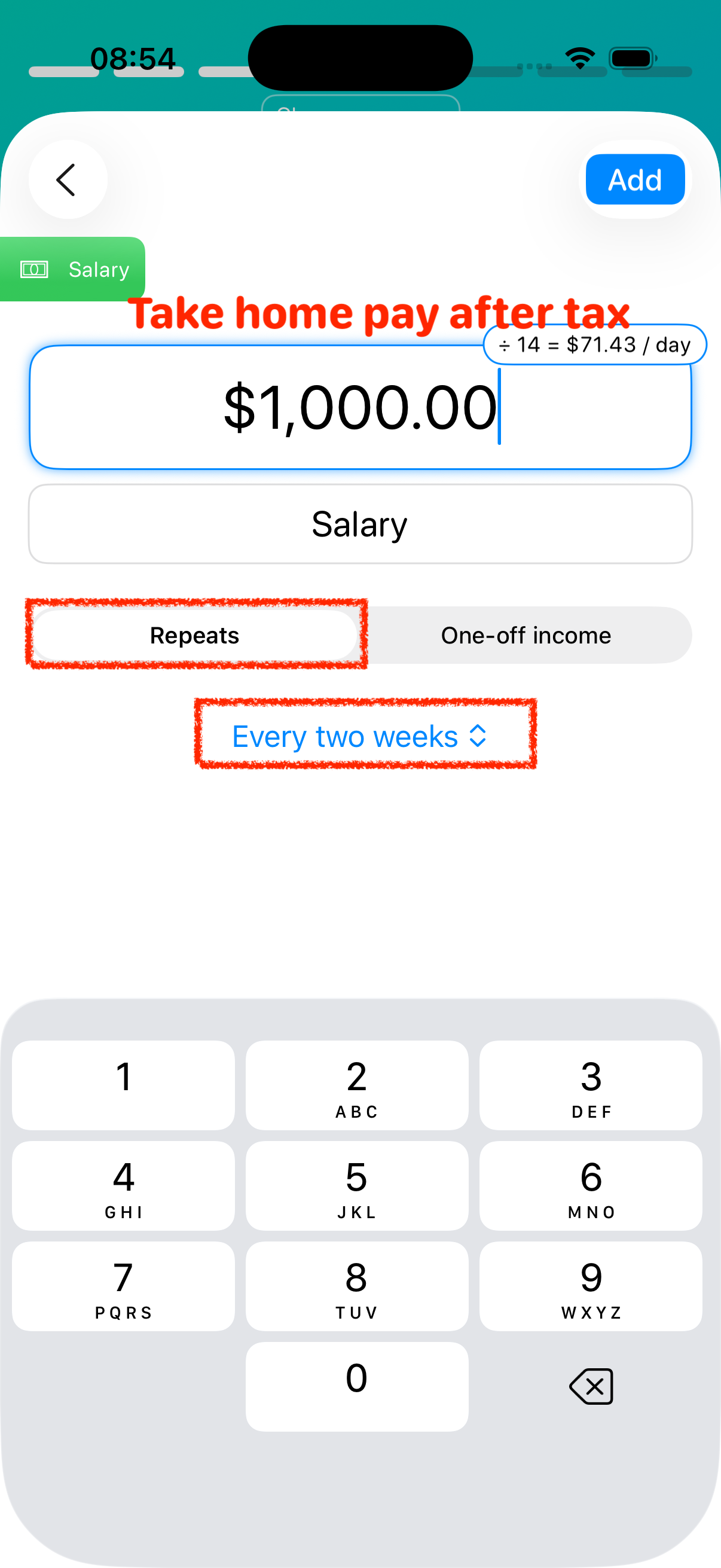

Repeat → For salaries or other steady pay that comes in on a fixed schedule. Enter your take home pay, and set the frequency like "monthly" or "every 2 weeks".

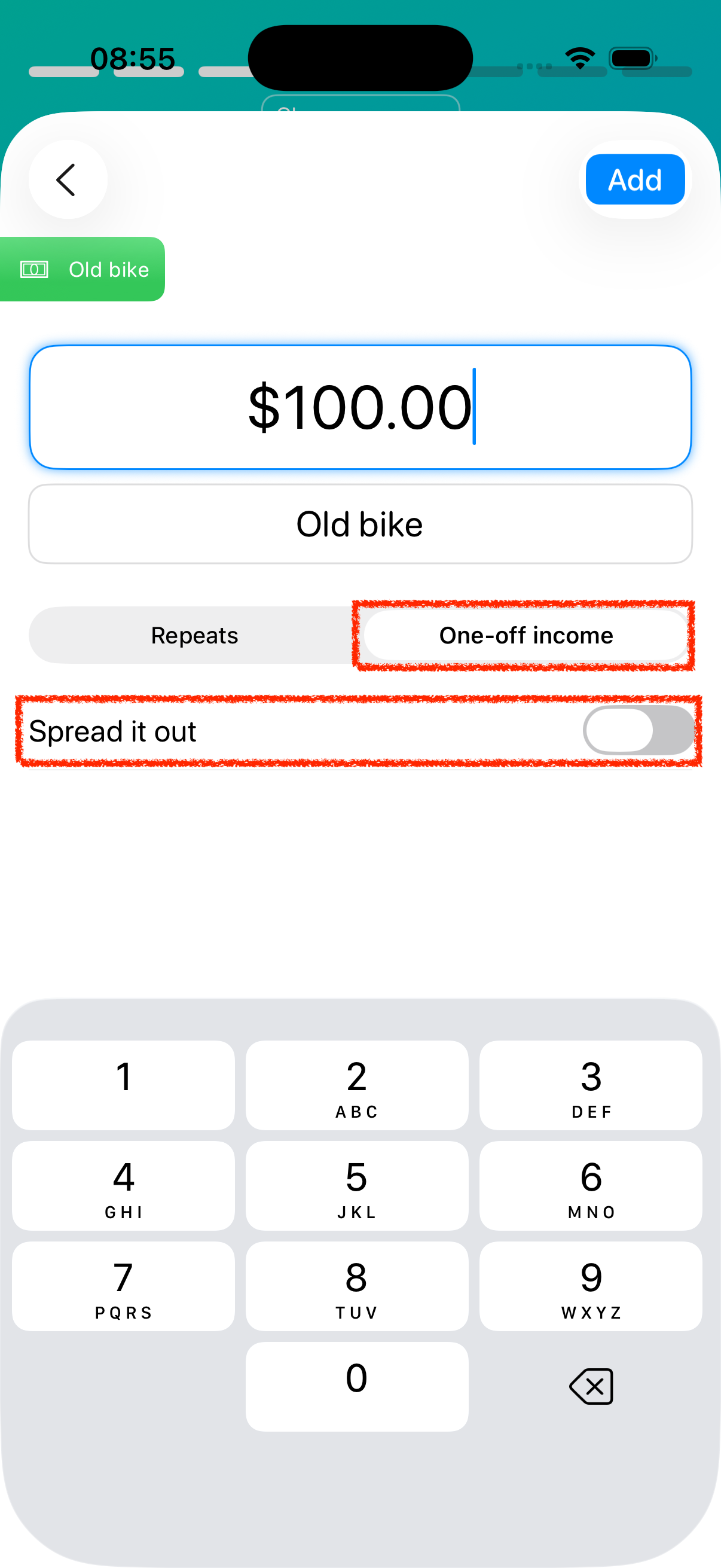

One-off income → For freelance, self-employed, or irregular income.

You can choose the number of days to spread out an one-off income. To decide how long to spread it out, think about when you’ll be paid next. If you know the date, spread it until that payday. When in doubt, it’s safer to be conservative.

For irregular amounts, like selling something online, enter it also as one-off income. If the amount is small, toggle off "spread it out" and the full amount will be added to Today’s Budget right away.

How to enter debts

A fixed monthly payment (like a loan or credit card)

1. Tap the ➕ Plus button

2. Select Recurring expense

3. Create your entry and enter the payment amount

4. Choose the correct frequency (monthly, every 2 weeks, etc.)

The app will automatically set aside a little bit each day so the full amount is ready by the due date.

📅 Optional: If you know when the debt will be paid off, go to the Log, tap the entry, and set an end date.

Flexible payments (like a line of credit)

1. Enter each payment as a regular expense

2. Tap “Spread it out”

3. Choose how long to spread it over (like until the next payment)

This helps smooth out the impact across multiple days instead of all at once.

Update a recurring expense or income

1. Open the recurring expense entry.

2. Tap on “Update next payment.”

3. Enter the new amount for the bill.

4. Select the date when this new amount should take effect.

This way, your recurring expense stays up to date without needing to create a new entry each time!

How to save and spend for a holiday

When planning a holiday, there are two ways you can use savings goals.

1. Save for each expense separately 🎯 (Recommended)

Create a savings goal for each item (for example: flights, hotel, activities).

When you reach 100%, log what you actually spent.If you spend less, the leftover is added back as income.If you spend more, the extra is logged as an expense.

2. Save one total amount

Create a single savings goal for the full holiday budget.

Once you’ve saved 100%, you can: Delete the goal → this adds the full amount to your spendable balance. Then, log each expense (meals, gas, tickets, etc.) as you normally would.

💡 Tip: If you’re traveling abroad with a different currency, you can manage your holiday funds in a separate wallet. Watch the tutorial below:

How to enter expense that I paid with a credit card?

Please enter just once, like "$20 - Eating out".

The app is designed to focus on the amount rather than the payment type whether it's cash, a credit card, or a debit card – money is money. The essential aspect is controlling the expense itself.

How to enter an overdue bill?

Our app doesn't keep track of the due date, or if it's overdue, so you don't have to worry about that part. It's all about how much cash you've got left. For instance, if your bill was originally $10 but has a late fee making it $12, just enter $12 as the expense.

How to enter income on the 1st and 15th instead of 2 weeks?

Currently, our app doesn't have a specific feature to input income on the 1st and 15th. However, a workaround would be to add two separate payments and set them as monthly income. The app will then use this information to calculate your daily income. If you get paid the same amount every month, this approach works perfectly.

Saving & Investing

Overview: Ways to save money with Today’s Budget

Looking for ideas to grow your savings? Here are many ways you can use Today’s Budget to put more aside:

1. Create a savings goal (for a vacation, gadget, car, or house)

2. Spread out bigger expenses (like grocery shopping or a emergency vet bill)

3. Set up regular monthly savings

4. Put extra into the savings jar

5. Use "Save balance" for leftover cash

6. Add one-off income to savings

7. Build an emergency fund

8. Use savings to cover a negative balance

Put aside money for the future

Toggle the piggy jar on the main page to go to the Saving jar > + > Regular saving. Enter how much you want to save every month. The app will automatically set aside a little each day, so your savings grow without you thinking about it!

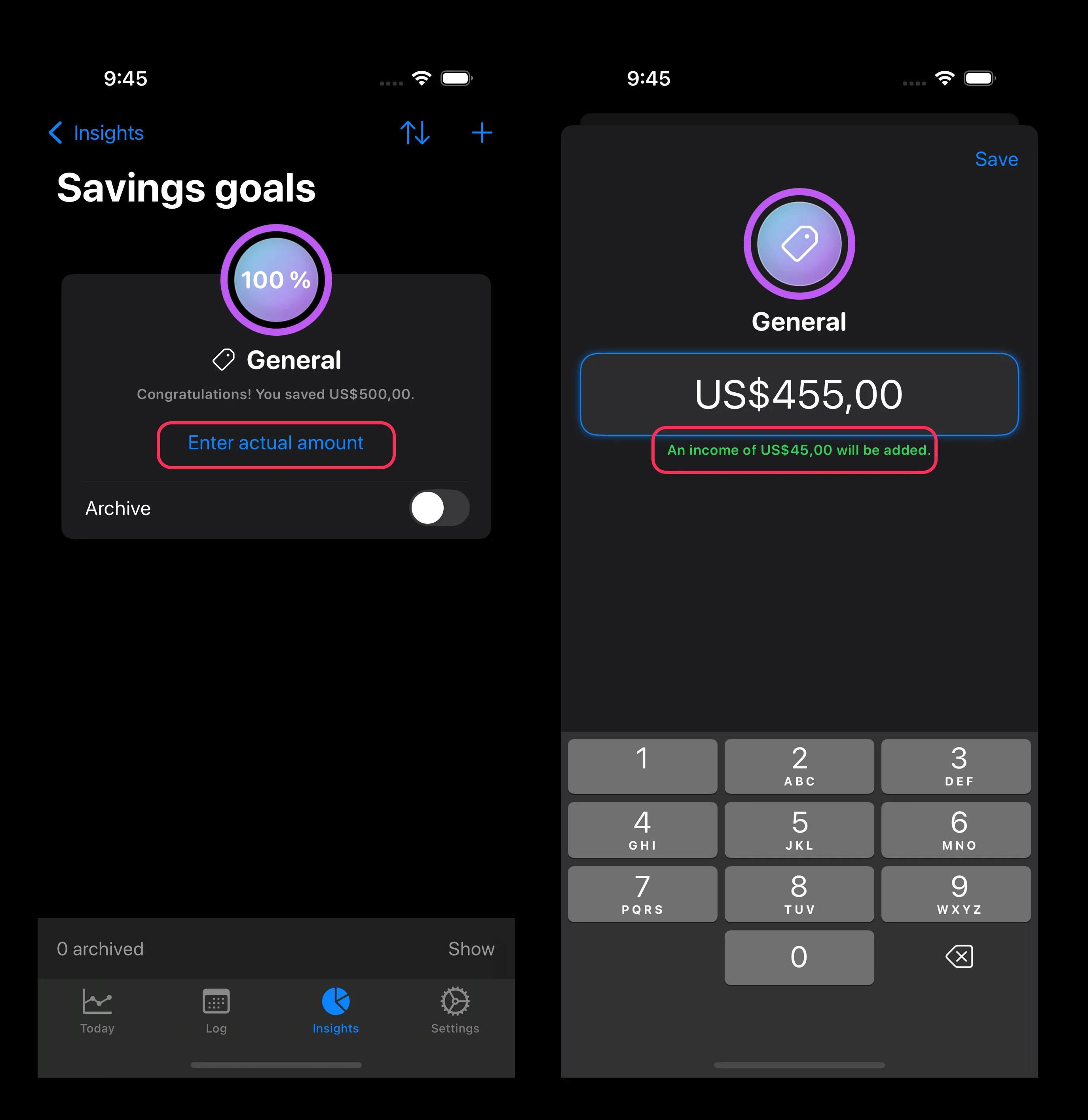

How to use a savings goal

A savings goal helps you set money aside for something specific — like a trip, a new gadget, or any big expense.

Set your target

1. Tap + to open the menu.

2. Select "Savings goal"

3. Enter how much you want to save and the date you want to have it ready by.

The app will automatically put aside a little bit each day so you’ll reach the target on time.

Use your savings

Once you’ve saved 100%, there are two ways you can use the money:

Single purchase → Enter what you actually spent.

If you spend less, the leftover goes back in as income. If you spend more, the extra is logged as an expense.

Multiple purchases → If you’ve saved one amount for several things (like flights, hotels, and activities), just delete the savings goal once it’s complete. Then log each expense separately as you go.

Why you only see two days ahead (and how to check your future balance)

Why

The main page only shows up to two days ahead, and that’s by design.

1. It’s unrealistic to assume zero spending.

If the app showed your whole future balance without daily expenses, it would give you an inflated picture and might tempt you to overspend.

2. It helps you focus.

Limiting the view to the immediate future keeps you grounded, making it easier to make quick, confident decisions day by day.

How to check further ahead

You can still see your balance on a future date if you want to:

1. Open the Log

2. Scroll to a future date

3. Check the balance at the bottom

Log a stock purchase

When you purchase a stock, you can enter it as savings. For example, if you purchased Apple shares for $10,000, add a new one-time savings entry for this amount.

Log a stock sale

When selling a stock, withdraw the same amount from your savings that you originally entered when you purchased it (e.g., withdraw $10,000 for the sold Apple shares).

Recording a profit or loss:

If you sold the stock at a profit, enter the amount as new income in the "Profit on stock" category (e.g., $2,000 profit from selling Apple shares for $12,000).

If you sold the stock for a loss, enter a new expense in the "Loss on stock" category (e.g., $5,000 loss from selling Apple shares for $5,000).

Note: You can delete the original savings entry when selling a stock and only record the gain or loss. However, we don't recommend this method as it eliminates information about when you bought and sold the stock, making it harder to track your investment performance.

Can I add savings from the past?

You don’t need to enter past savings for the app to work. Today’s Budget only uses your income and recurring expenses to calculate Today’s Budget.

But if you’d like to include savings you already have (like cash you plan to dip into), here’s how:

1. Enter the savings amount as one-off income.

2. Go to the savings jar, and choose Save an amount and give it a name like “Savings from the past.”

💡 Tip: Only include money you’re willing to use. We don’t recommend adding long-term savings you don’t plan to spend(like fore your retirement), since the savings jar is designed for flexible, everyday saving.

Categories

Create a category

(1) When you enter an expense, on the category selection page, tap on "Edit"

(2) Tap on "+" to create a new category

(3) Set the name and icon and tap "Save".

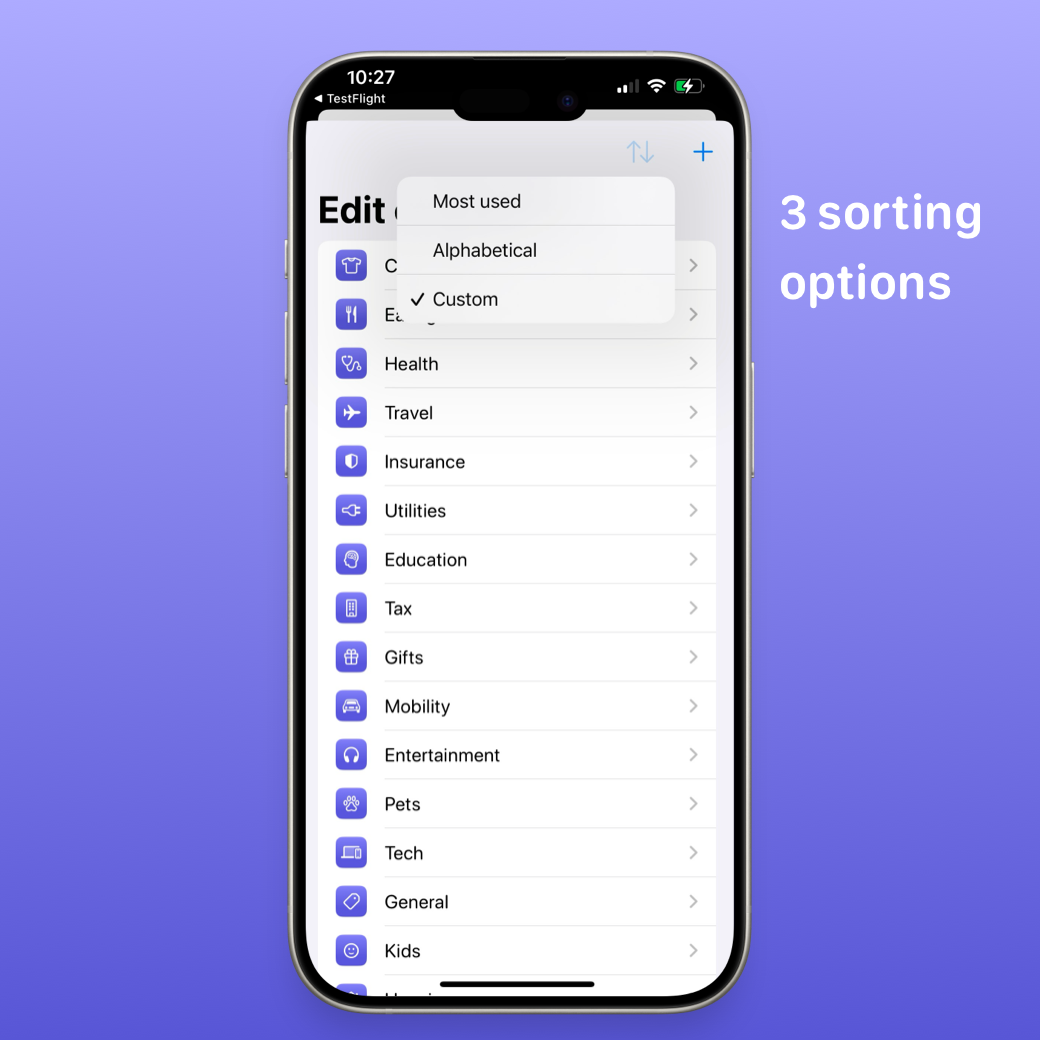

Change category order

By default, your most-used categories appear at the top. But you can also choose your own order, or sort them alphabetically.

Here’s how:

1. Go to the category selection page

2. Tap Edit

3. Tap the arrow icon at the top

4. Pick Custom to set your own order

5. Drag and drop categories into the order you want to see

Do you support budgeting by category?

Today’s Budget doesn’t split money into categories, and that’s intentional. Our goal is to keep budgeting simple and flexible.

Money is money — you decide how to spend it. Instead of juggling multiple budgets, you see just one number showing you how much you can spend everyday. As long as you stay within that, you’re on track, no matter which category the money goes.

How to save a category template

If you often use the same set of categories (for example, every time you go on a holiday), you can save them as a template so you don’t have to recreate them.

Here’s how:

1. Create an empty wallet and set up the categories you want.

2. Give the wallet a name like “Empty travel wallet.”

3. Create a backup of this wallet (Settings → Backup).

4. Whenever you need those categories again, restore the wallet from the backup.

Devices & Add-on

There is no Android version

Today’s Budget is iOS-only. We’re a two-person team, and we chose to focus on iOS so we can build a stable app with strong privacy protections. We wrote wrote about our decision here:

Why there is no Android version (Reddit post)[Apple Watch] Enter expenses on the go

With Apple Watch, you can log expenses in seconds — no need to pull out your phone.

[Apple Watch] Use complications

We currently offer four different complications, so you can always keep an eye on your spending power without opening the app.

Got an idea for a new one? We’d love to hear it!

[Shortcuts] Automate Repeating Expenses

Tired of logging the same expenses over and over? With Apple’s Shortcuts app, you can set up automations that do it for you.

For example, you can:

1. Create a shortcut in the iOS Shortcuts app that logs your parking fees 🚗. (Look for Today’s Budget in Shortcuts, then select Enter expense, and set the category, amount, and note once.)

2. Create an automation to run weekly — for example, every Monday, Wednesday, and Friday. Choose Run immediately.

Once it’s set up, the expense will be logged in Today’s Budget automatically, without you needing to remember or enter it yourself.

💡 Perfect for repeating costs like weekly classes.

[Shortcuts] Enter a set of expenses with one tap

Some expenses come in sets — they’re not fixed like rent, but they happen often enough that logging them one by one feels tedious. That’s where Shortcuts can help. Examples:

🏊 Pool day → Car sharing + Pool ticket

🏋️ Gym → Transportation + Gym class + Protein smoothie

🚙 School pickup → Toll + Parking + Toll

How to set it up:

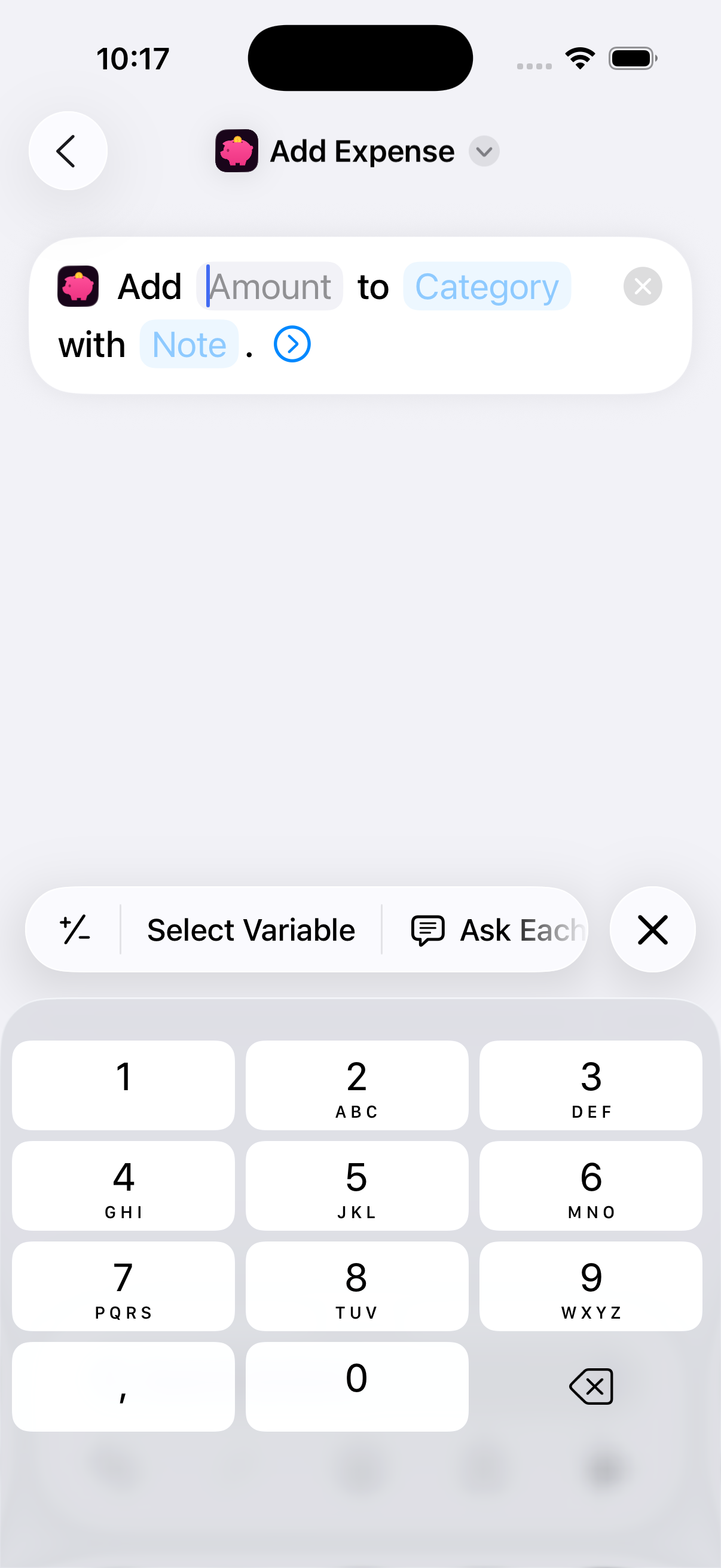

1. Open the Shortcuts app on your iPhone

2. Search for Today’s Budget

3. Tap Add expense

4. Set the amount, category, and note.

5. Repeat for each expense that goes together

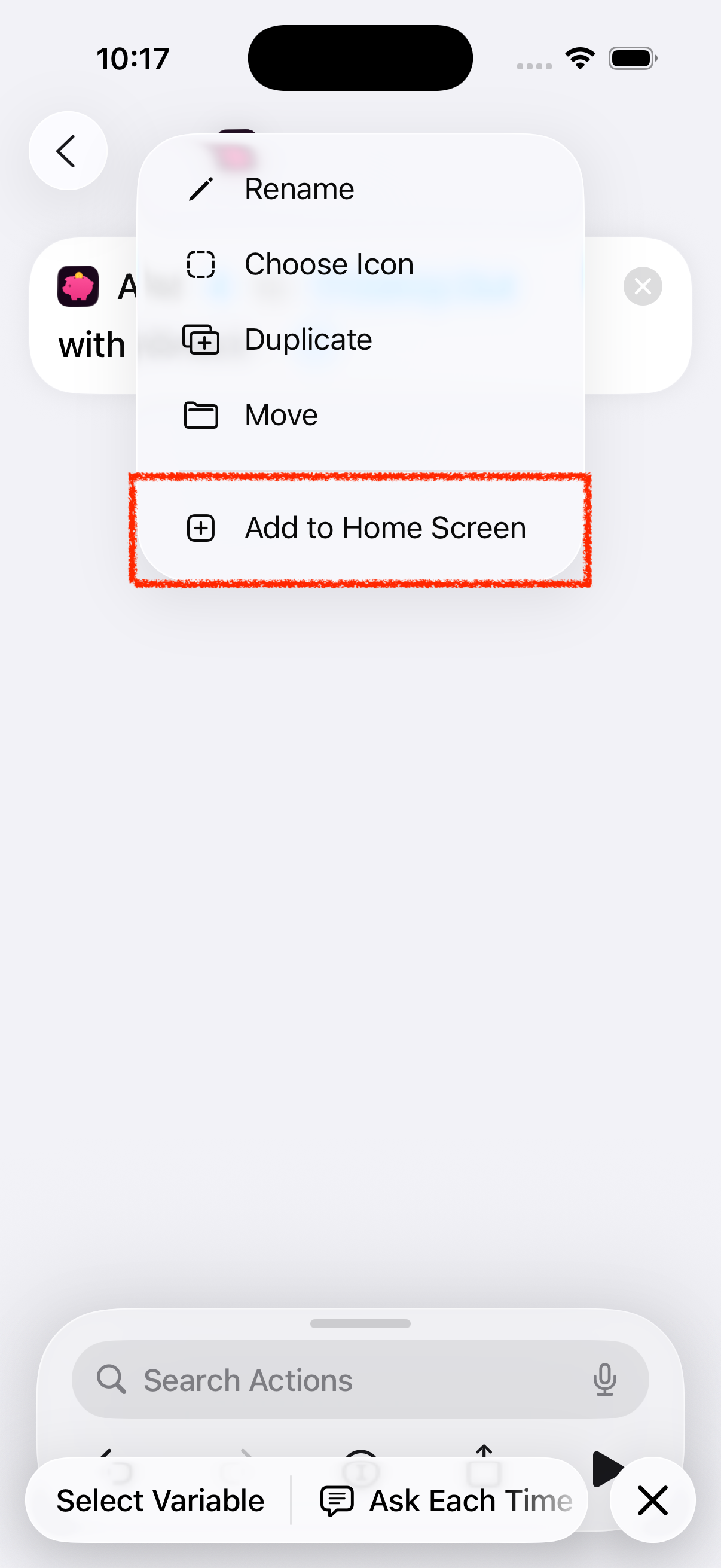

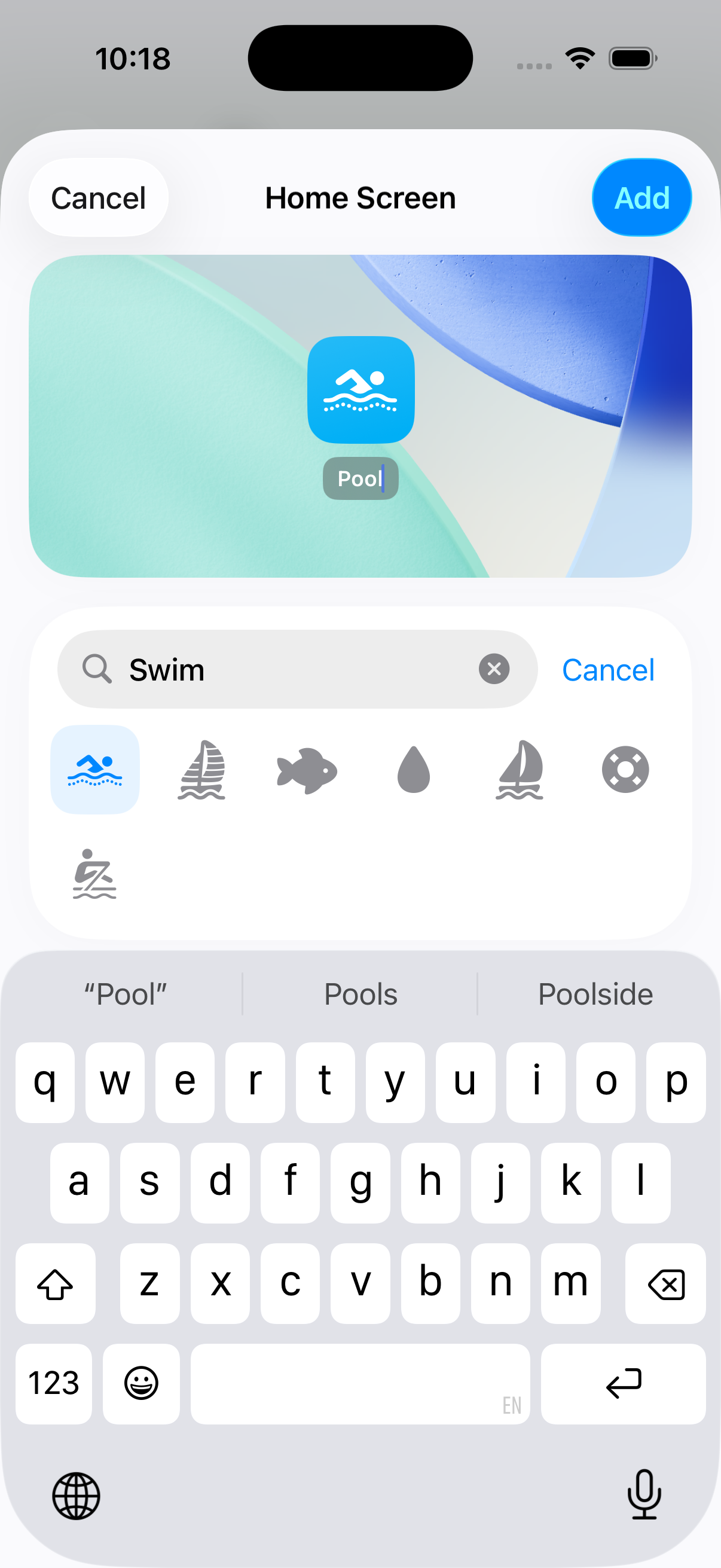

6. Tap the chevron arrow on top to open the menu, and select Add to Home Screen

7. Give it a title, choose color and an icon.

[Widgets] Add lock screen widgets

Want to see Today’s Budget at a glance, without unlocking your phone? Add it as a lock screen widget:

1. Touch and hold your lock screen, then tap Customize.

2. Tap the widgets area.

3. Scroll and pick Today’s Budget.

4. Choose the widget size you prefer.

5. Tap Done to save.

[Widgets] Add stand-by widgets

Want to see Today’s Budget at a glance, without unlocking your phone? Add it as a lock screen widget:

1. Touch and hold your lock screen, then tap Customize.

2. Tap the widgets area below the clock.

3. Scroll and pick Today’s Budget.

4. Choose the widget size you prefer.

5. Tap Done to save.

[Widgets] Add home screen widgets

We offer several home screen widgets:

- Small and medium widgets for checking Today’s Budget

- A monthly summary widget for tracking your progress

- A savings goal widget to see how close you are to reaching your goal

To add one:

1. Touch and hold your home screen, then tap the + in the corner.

2. Search for Today’s Budget.

3. Choose the widget type and size.

4. Place it where you like, then tap Done.

💡 Tip: Mix and match! For example, you can have Today’s Budget on the lock screen, plus a savings goal widget on your home screen.

Data

Use the app on a new phone

When you install Today’s Budget on a new phone and log in with the same Apple ID, your data will automatically download from your iCloud.

If you don’t see your old data right away:

1. Go to Settings > Manage wallets

2. Check which wallet you’re viewing

Chances are, you’re looking at a newly created empty wallet — just switch to your old one to see your history.

Why we don’t connect to your bank

No, Today’s Budget doesn’t connect to your bank to download your data — and that’s by design. Here’s why:

1. Better habits through manual entry

Entering each expense yourself (like that $5 latte ☕) makes you more mindful of your spending. It’s the small pause and the tiny sting that help you build lasting habits.

2. No delays, always accurate

Bank imports are often delayed. If the app shows you more money than you can actually spend, it stops being useful. With manual entry, your spendable amount is always up to date.

3. Safe and private

You never have to enter your bank login or PIN. And since most of us have more than one account anyway, keeping the app separate is simpler and safer.

💡 Entering expenses manually may take a little more time, but it’s the key to why Today’s Budget works: it keeps you present and in control of your money.

Also, users tell us that entering expenses is actually super fast in Today’s Budget, especially with Apple Watch ⌚ Try it and see how quick it feels!

Can I import CSV data?

No, importing CSVs is not possible.

Today’s Budget is designed to help you build better spending habits by entering each expense manually. Importing data would skip this important step.

The app uses its own format with frequency, start date, and end date. Bank statements or CSV files don’t follow this structure, so they wouldn’t work well with the app.

Entering expenses manually may take a little more time, but it’s what makes Today’s Budget effective for mindful budgeting.

Delete your data

The app doesn’t require an account. All your data is stored on your device and in your iCloud.

To delete everything:

1. Uninstall the app – this removes the data from your iPhone.

2. Delete iCloud data – go to Settings → tap your Apple ID → iCloud → Manage Storage → Today’s Budget → Delete Data.

Once done, all your information will be permanently erased.

Moving from Daily Budget Original

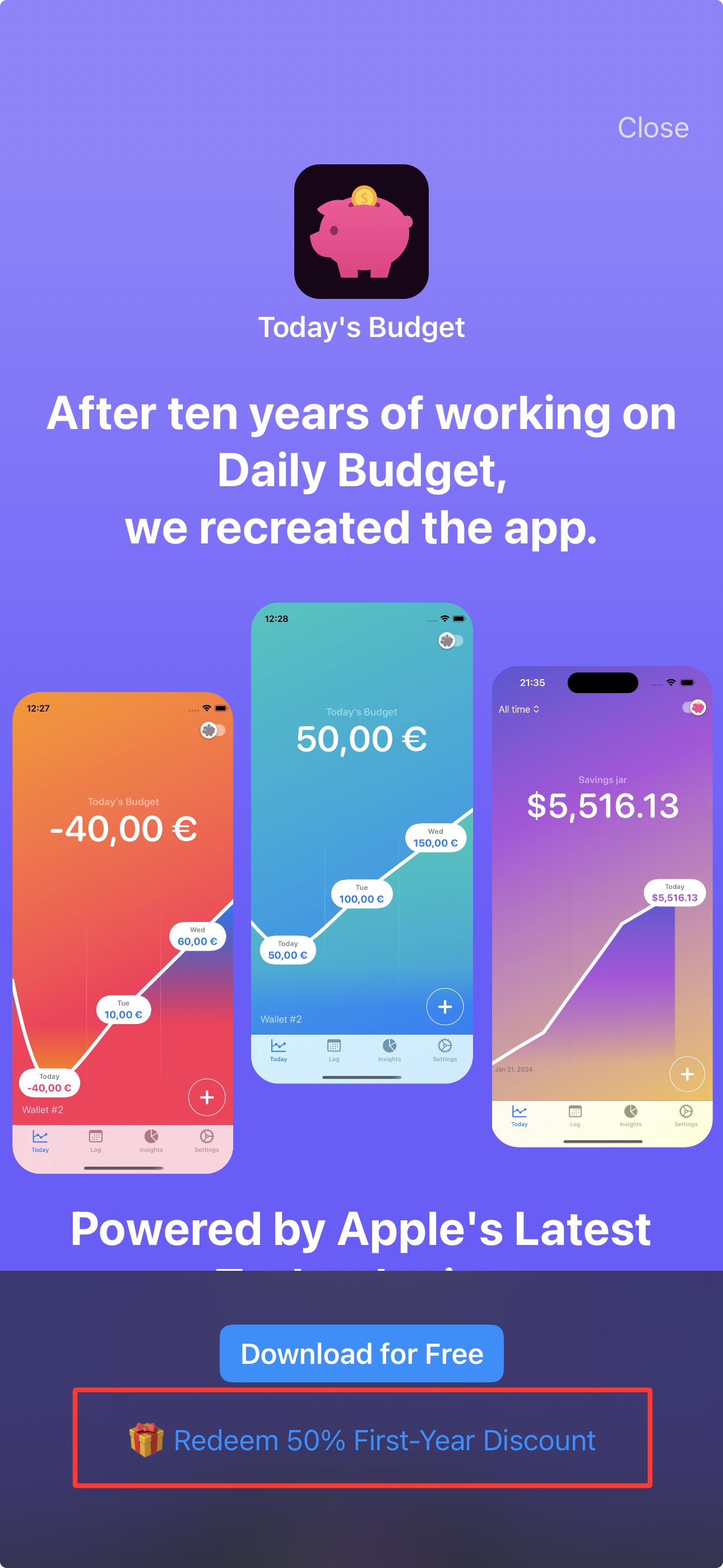

What’s the difference between Today’s Budget and Daily Budget Original?

We’ve taken everything we learned from more than 10 years of building Daily Budget, and created a new app around the same simple idea — one number a day — but with many more features, and using Apple's latest technologies.

Since iOS 15, Apple has introduced powerful new technologies like CoreData with sharing and encryption. We decided to take advantage of them, and build an app with rock-solid data stability, and room to grow.

Here’s what’s new and better:

Fresh design, same simplicity

A cleaner, more intuitive interface that makes budgeting easier than ever.

Smarter insights

Interactive graphs let you track categories and spot trends in your spending at a glance.

Saving Jar

A dedicated place to put money aside, and take it out again when you need it. When you need extra cash, you can dip into what you’ve built up.

Recurring income & expenses

Assign categories to both recurring income and recurring bills, so your daily budget always stays accurate.

Multiple wallets

Create and manage more than one wallet, for family, travel, side projects, or whatever you need.

Sharing via iCloud (no Dropbox!)

Share a budget securely through iCloud. It’s easier, safer, and designed for multi-user sharing.

Emergency Fund

Put aside money for unexpected situations so you’re always prepared.

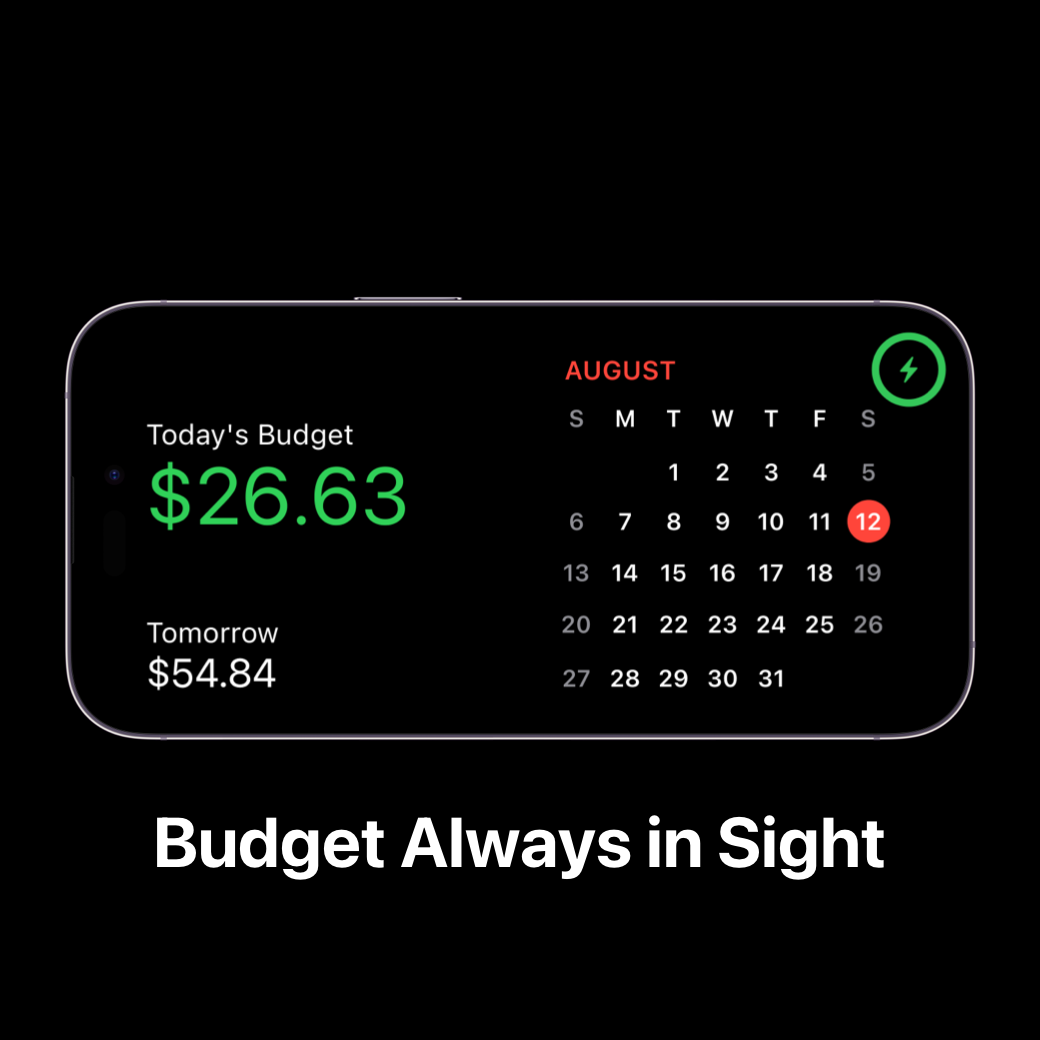

More ways to stay on track

Works across iPhone and Apple Watch, with widgets for your lock screen and home screen so your budget is always in sight.

💡 Today’s Budget is everything people loved about Daily Budget Original, rebuilt with modern technology and packed with features for the next decade.

Get a discount if you used Daily Budget Original

You will get 50% off from the yearly subscription for the first year. Go to Menu in Daily Budget, tap on "New app Today's Budget" then tap the discount link on the bottom.

Can I transfer my data from Daily Budget Original to Today’s Budget?

Unfortunately, the two apps use different data structures, so direct transfer isn’t possible. But don’t worry, Today’s Budget is super quick to set up, and you can start fresh right away! We recommend using it as a fresh start.

Privacy

How Today’s Budget protects your privacy

Your data is yours.It’s stored only on your device and our personal iCloud. Sensitive data is encrypted on your device first, before anything goes to iCloud. Nothing is ever sent to our servers or anywhere else.

💡 This means no one but you has access to your data!

Payments

How “pay once” works

With Pay once, you make a single one-time purchase, not a subscription. That payment unlocks Today’s Budget permanently, and you’ll continue to receive all future updates at no extra cost.

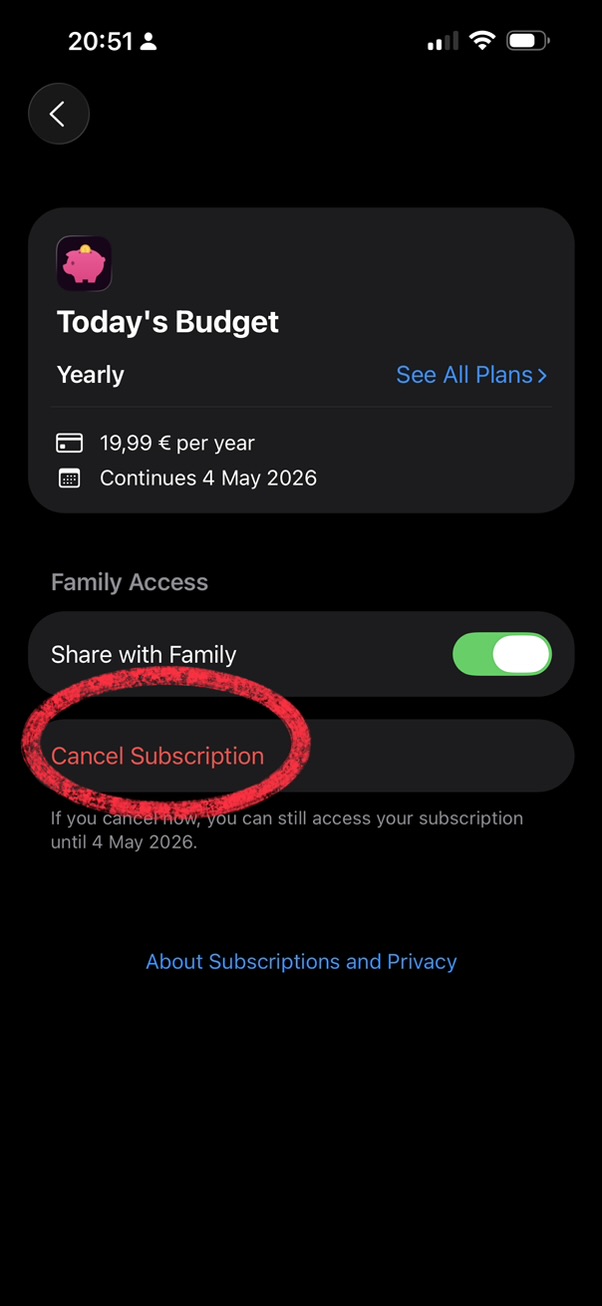

Cancel your subscription

There are two ways to cancel:

Option 1: From iPhone Settings

1. Open Settings

2. Tap your Apple ID (at the top)

3. Tap Subscriptions

4. Select Today’s Budget

5. Tap Cancel subscription

Option 2: From the app

1. Go to the Premium page in Today’s Budget

2. Tap Manage subscriptions

3. Tap Cancel subscription

Request a refund

All payments and refunds are handled directly by Apple.

To request a refund:

1. Go to reportaproblem.apple.com

2. Sign in with your Apple ID

3. Choose Today’s Budget from your purchases and follow the steps

Legal

Terms & Condition

Apple’s standard Media Services T&C applies to Today’s Budget. Legal - Apple Media Services - Apple

End User License Agreement

Apple’s standard EULA applies to Today’s Budget. https://www.apple.com/legal/internet-services/itunes/dev/stdeula/

Beta

How to Join

First, download TestFlight from the App Store. This is an official app from Apple for beta testing.

https://apps.apple.com/de/app/testflight/id899247664?l=en-GB

Then, click the download link sent from us, or posted on SNS.

What happens to my data?

Your data remains safe in your iCloud server just like the live version of the app. The beta version connects to the same iCloud as the live version, so your data is automatically saved and downloaded. You can create a backup file if you prefer (Settings > Backup), but it’s not necessary.

How can I share my feedback?

The TestFlight app will ask if you want to add a comment and share the feedback with us. Alternatively you can always email us.

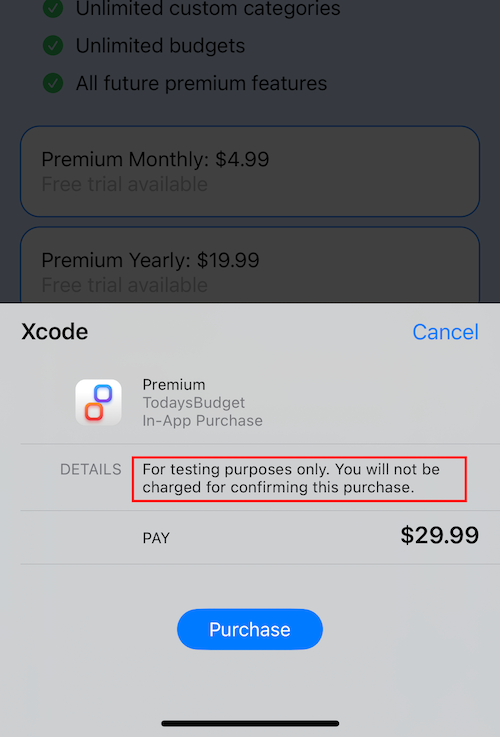

Premium version might be locked

Premium features may be locked upon downloading the beta. This is because beta versions are connected to a different "store". To unlock, please select “Premium - One time.” You will not be charged for beta builds, as indicated on the confirmation screen.

Trouble Downloading the Beta After Previous Testing

If you’ve participated in beta testing before, you may need to scroll down on the TestFlight page and select “Stop testing” to download a new version of the beta.

How long can I use the beta version?

Each version is valid for 90 days.

How do I stop testing the beta?

1. Head over to the App Store.

2. Search “Today’s Budget.”

3. Tap on “Update.”